No matter where you are in the US, we’ll get you affordable business accounting services for the best price.

If you’re a small business, you likely don’t need daily or weekly accounting services due to small size and lesser requirements than a large corporation. That’s why you can benefit from monthly accounting services that can process payroll once or twice per month depending your needs.

If you’ve been trying to handle payroll by yourself as the owner of the company or currently have an in-house bookkeeper but are looking for cheaper alternatives, consider us for monthly accounting services that bring a high level of convenience and time savings to your operations.

We also offer optional add-on services that can further help your payroll processes become more streamlined, from online employee access to tax filing services to direct deposit.

Managing your own books can be quite the daunting task. As the owner of a growing small or medium sized business, you have enough to worry about without adding accounting on to it all. Whether you have an in-house accounting service or you currently outsource for this service but suspect you may be getting a raw deal, it’s time to explore the many benefits of professional accounting services.

Just take a look at the statistics:

According to Accounting Today, 40 percent of small business owners say bookkeeping and taxes are the worst part about owning a company.

According to Accounting Today, 40 percent of small business owners say bookkeeping and taxes are the worst part about owning a company.- 47% of those said the financial cost was the number one reason for dissatisfaction, while 13% cited the headaches and time, and another 13% disliked how complex compliance laws were.

- 10% cited changing regulations as a source of their confusion, while the rest said they were disappointed with the tax code’s inequity.

- Small business owners spend more than 40 hours on tax prep every year, with some spending as much as 80 hours. Only 28% say they spend less than 20 hours a year on taxes.

- Most small business owners said they spent between $1,000 and $5,000 on outsourced tax prep, costs, legal fees and more. Sixteen percent spent upwards of $20,000. We can provide you competing quotes for one low monthly fee that will include EVERYTHING you need (payroll, accounts payable/receivables, tax preparation / filing and more) …all at a fraction of what you are most likely spending now.

Accounting is a big source of aggravation for SMEs, especially when they have to do it themselves or pay an in-house team to do it. Outsourcing your professional accounting services frees up your time and costs you less in the long run, as you’re not paying for benefits and insurance for your employees to do it. You get access to all the same services yet at a lower cost, contributing to a better bottom line for your business. Plus, you get greater flexibility because you can pick and choose the specific services you want. For instance, in addition to standard payroll processing, you can opt for corporate tax preparation and filing, debit cards, and online employee access so your workers can check their own accounts.

Professional monthly accounting services typically provide:

General ledger prep

General ledger prep- Financial statement prep

- Bookkeeping (daily, weekly or monthly options)

- Payroll processing (weekly, bi-weekly, monthly, semi-monthly)

- Accounting system set-up and support

- Accounts payable

- Accounts receivable

- Assurance and advisory

- Tax Preparation & Filing

Accurate record keeping for any business is crucial. However, it’s extremely time consuming and can be very confusing – especially for those who are not professional accountants or CPAs. Your time is better spent growing your business, not on handling your own accounting processes or paying big bucks for someone to do this in-house. Instead, rely on professional accountants and CPAs who do this for a living, yet in an outsourced setting that cuts overhead costs, offers greater convenience and flexibility, and reduces headaches.

5 Things to Expect From Payroll Outsourcing Services

Feeling the heat of doing your own payroll online? It’s time to think about outsourcing. Here’s what you can expect from payroll outsourcing services.

Payroll mistakes happen to the best of us. Even large law companies are not exempt from the possibility that their payroll may not be completely accurate.

Payroll mistakes happen to the best of us. Even large law companies are not exempt from the possibility that their payroll may not be completely accurate.

This kind of error can have large repercussions and can cost a business a lot of money to fix. It could even lead to fraud investigations against the company.

That is where payroll outsourcing services come into play. These services aid a company by taking over the time-consuming payroll work and ensures that it is all done correctly and efficiently. It is one of the accounting solutions that can be successfully outsourced to professional service providers.

If you’re new to payroll outsourcing, you may not know what to expect from these kinds of services. Continue reading to learn more about them.

1. How Does a Payroll Service Work?

Once you’ve selected the provider that you wish to work with, you’ll need to set up the system. This will depend a little on the particular provider you’ve chosen as they will likely have their own way of doing things. However, most likely the setup of your payroll system will include with sending in a payroll report.

This report will be used by the provider in order to process your payroll information. They’ll want to collect the number of employees your company has, benefit policies, the number of hours worked, any vacation pay, and potentially more. They will use all of this information to accurately calculate your payroll.

Once you’ve sent all of the needed information, you shouldn’t have much more to do. It will be up to your provider to take care of everything else at this point.

2. What Services are Included in a Payroll Service?

It’s a misconception to believe that payroll outsourcing services only handle the payroll side of things. They can do this, and only this, if you so choose, but more often than not you’ll want to take advantage of the other services that your payroll provider can give you. These kinds of services can include, but are not limited to:

It’s a misconception to believe that payroll outsourcing services only handle the payroll side of things. They can do this, and only this, if you so choose, but more often than not you’ll want to take advantage of the other services that your payroll provider can give you. These kinds of services can include, but are not limited to:

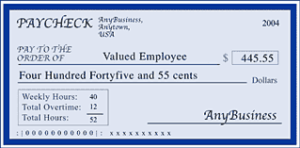

Processing payroll and administering paychecks on a regular basis to your employees. This process will take into account all of the intricacies such as hours worked, benefits, overtime, etc.

The provider will file payroll taxes. They will take care of all the quarterly tax reports and withholdings in accordance with your company’s state law. They can also handle W-2 and 1099 end-of-the-year forms.

They will provide a self-service application that will allow your employees to access the system. They’ll be able to view their pay stubs, year-end tax forms, and PTO balances.

Most systems will allow for there to be mobile access to the system as well as reporting new hires to the government automatically.

They can also take care of any management for paid-time-off. They’ll keep track of the amount of vacation and sick hours that your employees have used and how much they still have yet to use up.

3. How Much do Payroll Outsourcing Services Cost?

The cost for these services will vary from company to company. It also will depend on how many of the individual services you intend to use. However, there are some typical standards that most services use that can give you a better idea as to how the pricing will go.

The cost for these services will vary from company to company. It also will depend on how many of the individual services you intend to use. However, there are some typical standards that most services use that can give you a better idea as to how the pricing will go.

To start, there is normally a base fee. This will be charged either per month or every time you run payroll. This base fee can range from anywhere between $20 to $100. Most providers will also ask for an additional fee of $1 to about $10 per each employee in the payroll.

Of course, it is possible to have extra costs added on initially, such as setting up the system or doing year-end taxes. It ultimately comes down to what the provider is asking for.

4. Why Use a Payroll Service Company?

At the end of the day, there are many benefits payroll outsourcing services can give your company.

The biggest of these benefits is the fact that all of the work to keep your payroll system in place and running smoothly will be completed for you. You won’t have to worry about money-costing mistakes or anything being turned in late.

These providers will save your company in labor time you will be able to free up the employees who would normally do this work. Instead, they can be used to better effect elsewhere.

Another great benefit is the fact that payroll outsourcing services are better suited to ensure that the payroll system and all of the services comply accurately with the laws and regulations. They’ll be able to keep up with any changes that may occur from quarter to quarter.

Ultimately, these service providers will give you peace of mind while handling your payroll in an accurate and efficient manner.

5. How to Choose a Payroll Service Company?

Because there are many different payroll outsourcing services available to choose from, it can be difficult to know which one would be the right choice for your company. These services vary from place to place, but there are general items you can look out for in order to see if that particular provider will work well with your company.

You should look at the different options the service provides and see if they require payment per month or per payroll. You can also research whether or not they offer things such as direct deposit, garnish payments, detailed payroll reports and more.

You also want to keep in mind how easily you can work with the provider. You’ll want a system that is easy-to-use and not too complex. This will ensure that you can add any new employees to the system with relative ease instead of taking hours away from your work time.

And of course, the cost of the service will play a big part in your choice as well. Find the provider that will give you the best solutions to your payroll needs for a comfortable and affordable price.

Outsourcing May Be the Right Solution for Your Company

Now that you know more details about how payroll outsourcing services work, you can better determine whether or not these kinds of services will help your company.

These services can be incredibly helpful in keeping a company from making payroll mistakes and, in the end, save you money.

Are you interested in outsourcing your payroll services? Get Local or National Payroll Services in ALL US Cities.

Affordable Payroll Services – Nationwide Service

2133 Upton Drive, Ste 126 PMB 165

Virginia Beach, VA 23454