How to Pick The Right Payroll Service for Just One Employee

Need help with payroll but only have one employee? Find the right option for you with this complete guide to choosing a payroll service for one employee.

Need help with payroll but only have one employee? Find the right option for you with this complete guide to choosing a payroll service for one employee.

There are now more than 30 million small businesses in the United States.

Many small businesses are operating with few employees. Some small businesses only have one employee.

Taking care of administrative duties in your business can take away from important tasks like increasing revenue and profit margins. One of the ways you can decrease the time you spend on administrative tasks is by finding a payroll service for one employee.

Continue reading through this article as we answer your questions about payroll for your business.

Answers on Payroll Service for One Employee

Running your business doesn’t have to be filled with stress. You’re good at what you do, but you don’t love taking care of the administrative tasks. While there are some tasks you can put on the back burner, payroll is not one of them.

If you have only one employee, you probably figured you were stuck handling their payroll. After all, you can’t outsource a payroll service for one employee, can you?

Can I Outsource Payroll for One Employee?

No matter how big or small your business is, you can outsource payroll.

Is a Payroll Service Expensive for One Person?

Depending on which service you use, you may save money using a payroll service. Often, the time you take off work to do your own payroll will cost you more than paying someone else to take care of it. Most companies will need to customize your quote depending on your needs.

Can a Payroll Company File Taxes and a W-2 for One Employee?

There are payroll companies that will file taxes and a W-2 for one employee. Before working with a payroll company, make sure to ask them if this is a service they offer.

Do it Yourself Payroll vs. Outsourcing Pros and Cons.

Doing your own payroll doesn’t always save you money. If you aren’t trained in payroll, there are likely to be errors from time to time. Even a simple error can cost your company big money.

The possibility of errors is one of the major cons of doing your own payroll. If you have a payroll company taking care of your payroll, they’re trained to do this. Not only are they trained, but if they make any mistakes, they’ll take care of it.

Another major con of doing your own payroll is that it takes away from your focus. As a small business, you need to be focused on growth. There isn’t a lot of margin for error or slacking up on work when there are only a couple of people working in and on the business.

The only pro to doing your own payroll is the ability to control the process. Having to “touch” everything is one of the downfalls of being a small business owner. It’s hard to let go of control because you have so much invested in the business.

While being able to know you took care of payroll might make you feel more in control of your situation, it isn’t always helpful to your business.

What Are the Best Payroll Companies for One Person?

These are three of the top services you can use for your small business payroll needs:

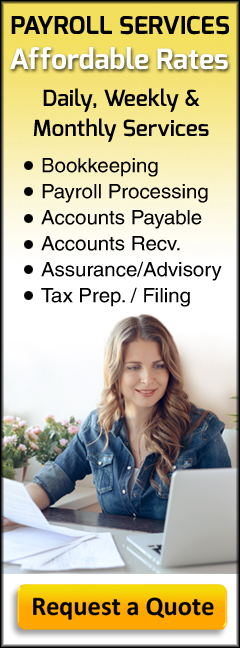

Super Affordable Payroll Services helps companies with one employee by taking care of all their payroll needs. They offer other services that help businesses so if you need more help with your admin tasks; you can use the same company.

Gusto helps businesses by allowing your employee to onboard themselves. If you offer health or 401(k) plans, they can help with integration.

OnPay can management payments, payroll filings and deductions, and pay your employees via direct deposit or through paper check.

Important Things to Consider When Switching to a Payroll Service

If you’ve decided you don’t want to risk taking care of your own payroll, there are some other things you should consider when looking for a service. You want to make the transition as easy as possible for your business and your employee.

1. When To Convert

When you convert to a payroll company is almost as important as who you use as your payroll provider. Converting mid-year isn’t going to cause major problems, but some people find it is better to wait until the end of the year to convert.

If you want to convert to a payroll company at the end of the year, start the converting process in October. Beginning the conversion in October will allow you to avoid any conflict with year-end processing.

Whenever you do decide to convert, the process needs to be streamlined to make sure there is a smooth transition. Work with the sales team at your new payroll company to implement the transition as smoothly as possible.

2. Data Integration

Do you need help with data integration? Since your business is very small, you may choose to keep things as simple as possible. But, if you need data integration help now is a good time to learn about your provider’s solutions.

3. Payroll Tax Compliance Management

You want to make sure that you’re covered and compliant with tax laws. Ask your payroll company sales rep how they manage taxes and make sure they are paid out properly.

Payroll taxes often change so working with a company that is always up to date on education is important.

4. Customer Support

The payroll company you’re working with should have a readily available customer support team. Don’t be afraid to ask questions about professional payroll certifications the staff has or how you can contact support. You should have access to a professional that can help you with complex situations you might be dealing with.

Someone that can help you with your questions about ACA compliance should be available when requested. These are important issues and could result in major problems if you don’t help with those questions.

Using the Best Payroll Company for Your Single Person Business

When you run a small business, having a payroll service for one employee takes one more task off your plate. You’ll get rid of administrative tasks so you can focus on business growth.

However, if you’re an employee that needs legal professionals to help with your employment concerns, then you may want to visit a helpful place like HKM.com for more info!

Request a quote today and see how we can help you do just that.